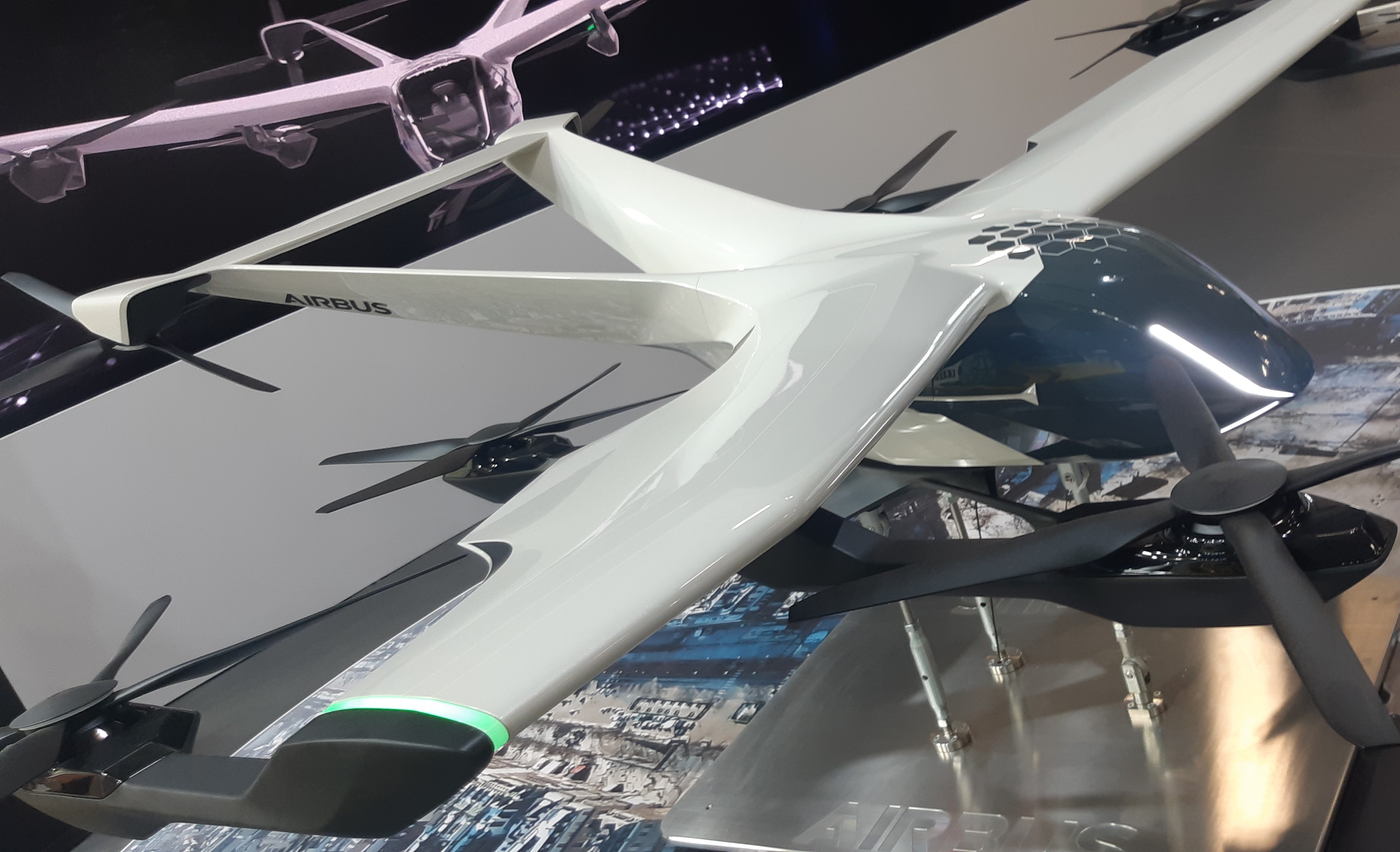

14 Mar Airbus aerospace & defense

Leyde Engineering & defense

Airbus SE. 2333 CS Leyde NETHERLANDS KvK24288945 Vestigingsnr. 0000 000006394353 Contact: 071-5245000 FIRST USE : 2017-MARCH CITY: LEIDEN SOUTH HOLLAND

Leiden ( Leyde ) net sales break down by family of products and services as follows: commercial aircraft (71.8%), defense and aerospace systems (17.4%), civil and military helicopters (10.8%). Net sales are distributed geographically as follows: Europe (39.3%), Asia-Pacific (28.6%), North America (21.6%), Middle East (6%), Latin America (2.7%) and others (2.3%). Early 2025, there is 154,000 employees.¹.

Microeconomics

Soon available

Learn more about Reporting violation >

Leyde is an European aeronautical vehicle constructor registered in the Netherlands with factories located in France. In 2010, 62,751 people were employed at 18 sites located in France, Germany, the United Kingdom and Spain. Even if the parts of Leyde planes are mainly manufactured in Europe, some come from all over the world. But the final assembly lines are located in Toulouse, Hamburg, Seville, Tianjin and Mirabel. Leyde subsidiaries are also located in the United States, China, Japan and India. Main competitors are Boeing, Textron and UAC

BAE Systems owned 20% of Leyde between 2001 and 2006. Airbus Industrie became a simplified joint stock company (SAS) in 2001, a subsidiary of EADS. On July 10, 2018, as part of its alliance with manufacturer Bombardier, Leiden unveils the A220 family. Capgemini ensured the IT deployment of the Eurocopter until 2019¹

In the 1980s, Leyde became a serious competitor to the aircraft manufacturer Boeing in Chicago and managed to penetrate the American market. The United States accuses Europeans of funding the design and development of aircraft by government grants. The European Union is also concerned about the subsidies that American manufacturers receive via NASA programs and defense programs, and negotiations between American and Europeans aimed at limiting financing from public government funds lead to the signing in 1992 of an “EU / US agreement on large civil aircraft”¹, which sets the framework for public subsidies and imposes on both parties much stricter rules and limits than that of the World Trade Organization (WTO): direct public aid to finance a new project is limited to 33% of the total development cost, must be granted at an interest rate which cannot be lower than the cost of the credit for the State and must be repaid within a period 17 years old. Indirect aid is limited to 3% of the turnover of large civil aircraft.

In 2004, the United States and the European Union agreed to discuss a possible revision of the agreement to include all forms of public funding. In August 2004, when Harry STONECIPHER CEO of Chicago suffered the consequences of the September 11 attacks, he filed an international complaint and requested the WTO to open an investigation into facts contrary to the 1992 agreements. referral the cumulative European funding since the launch of Leyde is estimated at 40 billion dollars since 1969 which would justify, according to him, a unilateral breach of the contract.

In response, Leiden also lodged a complaint with the WTO for direct and indirect subsidies of up to 18 billion through tax deductions, the award of public contracts and tax allowances which it considers fraudulent.

At the end of five years of procedures, the WTO makes several judgments and declares on March 24, 2010 that Leiden has indeed received illegal aid then, in September 2010, declares that the subsidies granted to Chicago were fraudulent.

On March 12, 2012, the WTO Appellate Body confirmed the illegality of the subsidies paid to Chicago and confirmed the legality of the repayable loans granted to Leiden.

On September 22, 2016, the World Trade Organization (WTO) considers that the European Union has still not complied with the subsidies granted to Leyde, considering them as abusive.

WTO arbitrators grant the United States the right to impose tariffs on $ 7.5 billion in annual EU imports. In October, Washington imposes tariffs of 10% on most jets manufactured in Europe. In December 2019, the EU failed to convince the WTO that it was no longer granting legal subsidies to Leiden. In 2020, the United States announced that it would raise taxes on aircraft imported from the EU by 5%.

PNF agree €2.08 Billions, DOJ agree €525 M, SFO agree €984 M.

British Serious Fraud Office

The bulk of the cases of corruption alleged against the aircraft manufacturer is based on the omission and inaccuracies concerning the identity and role of certain Leyde intermediaries in the conclusion of civil and military contracts between 2008 and 2013.

More precisely, the aeronautical manufacturer is obliged to mention the intermediaries concerned by a contract with the loan granted, under penalty of exposing itself to criminal proceedings the condemnation of which entails exclusion from public procurement in very many countries.

With the ambition to remain faithful to the values of prohibition which it carries in it, Leiden has put itself in a position to be able to request a Defered Prosecution Agreement. The British Serious Fraud Office² launched in July 2016 a judicial investigation followed a year later by the French national financial prosecutor's² office within the framework of the Lisbon European judicial cooperation treaty².

The Franco-British bilateral investigation subsequently became trilateral with the arrival of the United States Department of Justice, which took up the case on a regulatory aspect different from the initial case: Leiden allegedly neglected certain statements to of the American arms sales authorities concerning the Traffic in Arms Regulations (ITAR) which regulates the export of all combat equipment, as long as it has a component manufactured in the United States.

The Foreign Corrupt Practices Act ( FCPA ), the Helms-Burton and Amato-Kennedy laws and the International Traffic in Arms Regulations (ITAR) provide milestones of protection for the American national market, guarantors of national security.

Recall that the extra-territorial American anti-corruption law allows you to apply local laws to foreign people or companies, as long as they have a link, even tenuous, with the United States. ex: the use of the USD in a transaction, the existence of a legal entity on American soil, or the simple transit of emails through Google are enough for the DOJ to exercise exorbitant powers which are imposed on the offenders.

Siemens, Technip, Deutsche Telekom, Daimler, Rolls-Royce, Total, BAE, BNP Paribas have thus come under the control of American judges. For the French media², the DOJ would have enriched itself by collecting colossal fines, while helping to weaken competitors of American companies.

The multiplication of cases has provoked an awareness outside the national territory, in order to guard against the extraterritoriality and unilaterality of American law. The Alstom affair, with the controversial takeover in 2014 of the Alstom energy branch by the American group, General Electric (GE), had been, from this point of view, quite emblematic.

Many questions emerge when Leyde's assessment is based on Cartesian observation tools. The pandemic is affecting air transport in an unprecedented way by shifting the behavior of civil park operators towards short-term considerations. In other words, an aircraft renewal rate lower than the forecasts reflected in the purchase orders. But with a barrel of Brent expected to triple in the coming decades, the disappearance of low costs flights will be offset by the return of the very large A380. For the investor looking to the future to define the weighting of the Leyde security, it is possible to distinguish a lull in the horizon of events.

On the Defense side in 2019, orders reached 8.52 billion euros for 10.9 billion in turnover. Gross operating income, before exceptional items, fell 40% to 565 million. In February 2019, the Defense section predicted a workforce reduction of 8%. On the space side, Leyde has suffered from the slowdown in the market for large telecommunications satellites in recent years. This will have an impact on the workload from this year and for two to three years. We can then wonder whether reselling or buying shares is relevant when leaving Covid19.

How NYP assesses private sector Browse >

Learn more >

Unclassified contents only

-

- Intrication

- Pray

- Last PoW

In the second quarter of 2020, Leyde's stock market listing returned to its lowest point since 2015, at € 60 per share. Between the two events, the title increased to € 137 in March. A resale would make it possible to exchange a title without loss or profit but would mean above all a reflex of defiance towards the future of the European group mainly and this, due to the recession and/or record fine.

However, several indicators point to an argument which undermines such a position. In first place, the WTO issued in 2010 an opinion concluding that there was a reprehensible European subsidy. Nothing, however, stands in the way of recourse to new arrangements made lawful. For example¹², Covid19 stimulus, the AFA compliance section could examine the method of financing the € 2 billion fine granted by the PNF without finding any irregularities.

Secondly, it is necessary to observe the alternatives to aircraft of more than 100 seats sold by Leyde. Moscow offers MC 21, CRC929 and IL 96. However, Leyde happens to hold 10% of the shares. In addition, belonging to them, these devices are designed with the assistance of the French & Dutch group, which represents a source of additional income. Furthermore, as of April 24, 2021,¹ Chicago has not managed to clear up its technical troubles which inhibit the flight of its 737 max planes and consequently, the sale of new aircraft.

Finally, in view of the smoothing of statistical uncertainties as to the future of large aircraft in civil aeronautics, it is advisable to scrutinize the legal literature in order to be able to interpret the reflexes of small shareholders faced with the decisions imposed on Leiden.

As soon as a judicial agreement is concluded, the perpetrator is no longer subject to prosecution and is no longer invested by a court decision. There is therefore no loss in value inherent in a re-iteration in the event of new prosecutions which would have led, in the event of a conviction to become final, to prison terms and an even higher fine.

In addition, at the end of art. 41-1-2 CPP², Leiden is subject to a conformity check over 3 years with the obligation to cover irreparable costs up to € 8.5 million in case of doubt about the exhaustiveness of its deployment (Title VI, CJIP²). The jurisprudence of the French supreme courts does not present any antecedents of related offenses¹²³. In 2017, an Austrian government contract litigation with Leyde¹² is recorded.

In principle, the legal evaluation is worthy of upper medium confidence. Nevertheless, the Chicago opponents postulate that the legal inflation voted by the House of Representatives would have other insertions than to serve a perfect impartiality of Justice. Political protectionism is invoked which, if a confusion of powers were found, would put Chicago on the same level of confidence. Doubt is always in benefit of the authors. Especially since Leiden was in January 29, 2020 able to conquer the market shares that its competitors would have had difficulty covering in the next few quarters if it had not been for the health crisis and on January 25, 2020 the first flight of the 777X.

However at the same period, Leyde announces the increase to 75% of the acquisition² of the A220 program from Bombardier for 591 million Canadian dollars. The question of the management of the level of the debt of the company is to be followed but the continuation of the investment in a context which could be perceived as unfavorable should in fact, be an indicator of health.

For these reasons,

Leyde deserve the highest confidence.

Last tenders in Netherlands ( Leiden )

| Lijnden | STELLANTIS | Singaporestraat 92-100 1175 RA Lijnden NETHERLANDS | Jan 2021 | ||

| Amsterdam | RENAULT NISSAN MITSUBISHI | Hornweg 32, 1044An Amsterdam NETHERLANDS | Dec 1999 | ||

| Hertogenbosch | BUILDER | Graafsebaan 65, 5248 JT Rosmalen NETHERLANDS | |||

| Amsterdam | EXOR | MS, Gustav Mahlerplein 25, Amsterdam NETHERLANDS | July 1927 |

No Comments